Instacart Ads

Top Growth Categories on the Instacart Marketplace

In this article, we take a look at some broad consumer trends and category sales growth throughout the previous quarter on the Instacart marketplace.

As consumers increasingly shop online for groceries, sales on the Instacart marketplace and other ecommerce platforms rise. What’s interesting is that category sales do not rise uniformly. And so, over a period of time, their growth relative to brick and mortar sales of the same category differs.

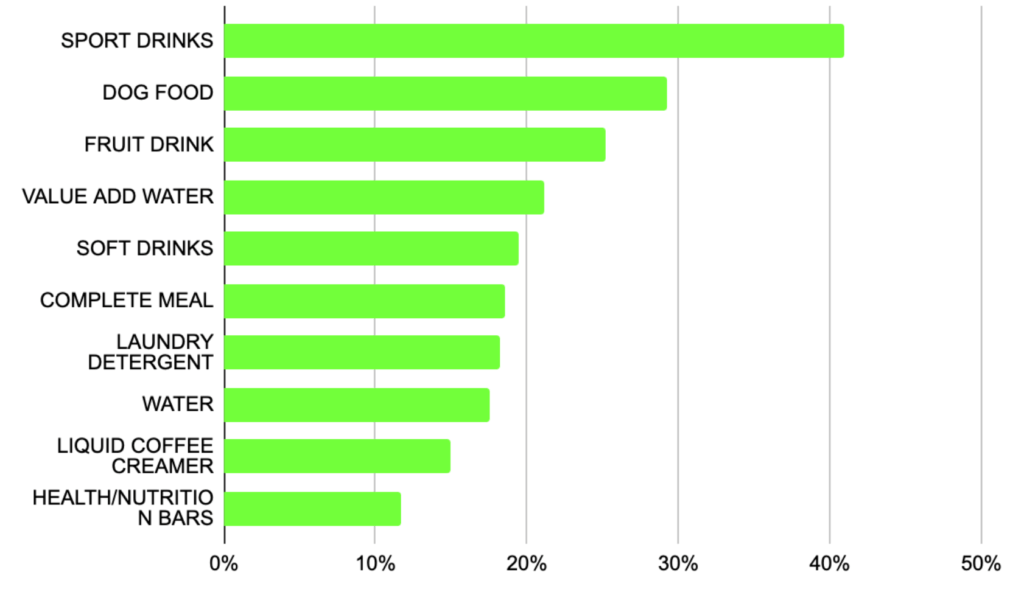

To find the fastest-growing categories, we examined sales on the Instacart marketplace for a period of time looking back 12 weeks from early September and compared it to the sales reported1 at brick and mortar stores for the same time period.

We found double-digit growth numbers for several categories of drinks, like sports drinks, fruit drinks, and water, foods with a convenience factor like health/nutrition bars and complete meals, as well as laundry detergent and dog food.

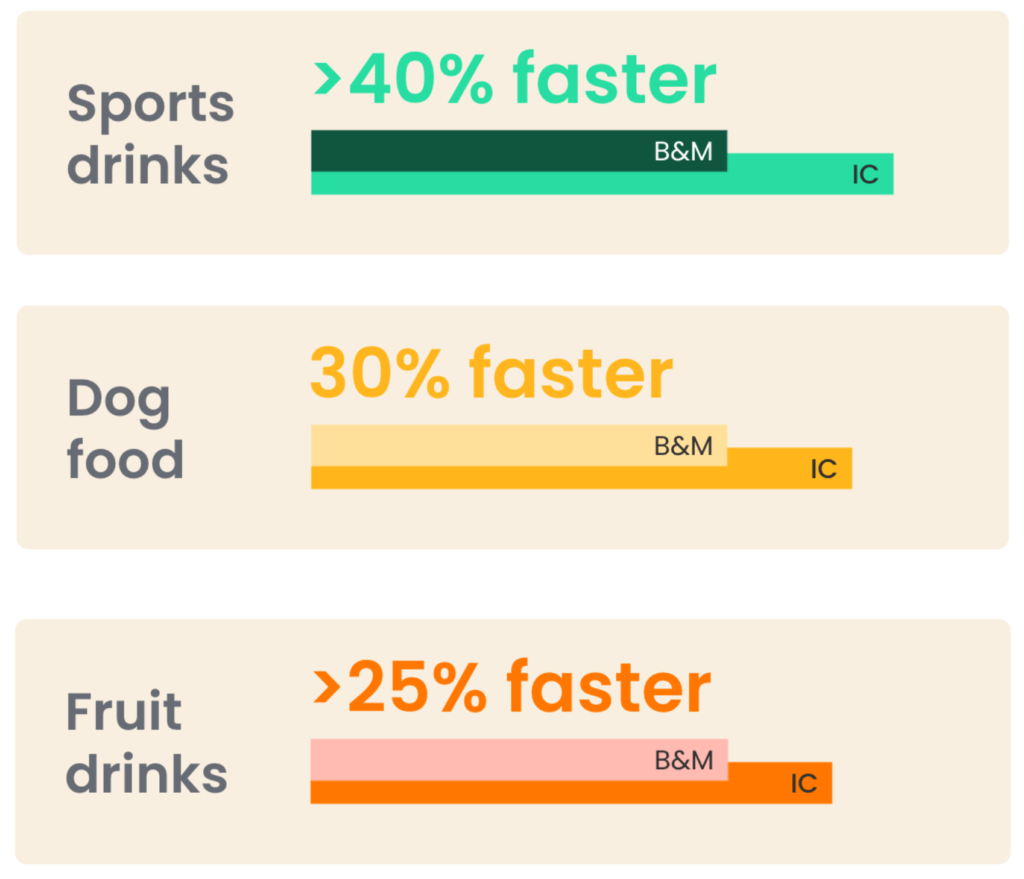

Sales in the sports drink category on the Instacart marketplace grew 40% faster than brick and mortar, followed by dog food at a 30% faster growth, and fruit drinks at 25% faster.

These three categories had the top three fastest relative growth. Looking at the list of the top ten, we see the next seven categories also have a double-digit faster growth on the Instacart marketplace relative to brick and mortar.

What do we mean when we say categories have faster growth on the Instacart marketplace? Since these figures represent category sales growth relative to brick and mortar sales, they do not speak to trends in the overall sales of these categories across all channels. So seeing dog food growing 30% faster on the Instacart marketplace does not mean people just recently adopted a ton of puppies. Even though the image that springs to mind is pretty cute.

Rather, it helps us identify, broadly, what consumers are using Instacart to shop for; all other things being equal, faster relative sales growth in these categories suggests more consumers are using Instacart to buy these products from their favorite retailers. While the demand for the products may not have changed materially, how consumers are buying those products has — shifting to online from in-person.

Looking for commonalities among the categories with the largest relative growth, we see a convenience angle. Both health/nutrition bars that can be a grab-and-go breakfast or quick snack and complete meals requiring little or no prep, are popular items for convenience-seekers.

It is also likely more convenient for most of us to have bulky items like a bag of dog food or cases of water and sports drinks delivered to our home than it is to pick one up while walking home from a friend’s.

These insights can also be of great benefit for our brand partners — the CPGs and manufacturers who chose to advertise with us to help consumers find products they will love. As sales for different categories grow faster online relative to in-store, advertisers need to think about their advertising and marketing efforts, what channels they use, and the mix of ad dollars they dedicate to each channel.

Beyond the categories with the top ten fastest growth, our analysis identified another 15 categories which had notable sales growth (5-10%) on the Instacart marketplace. Lots of these categories are commonly found in a typical weekly grocery shop — such as potatoes, chicken, pasta, packaged lunch meat, cereal, crackers, dairy yogurt — suggesting that online grocery shopping, both on the Instacart marketplace and more broadly on ecommerce platforms, can be a great growth enabler for a wide range of brands.

Brands planning for 2022 should be considering the relative growth in these categories so they are placed to capitalize on it.

Interested in learning more about how consumers shop online in categories relevant to your business? Consider partnering with us.

1 – Source: NielsenIQ Homescan Panel

Most Recent in Instacart Ads

Instacart Ads

Fire & Smoke Society Spices Up Sales with Instacart Ads

Fire & Smoke Society, the makers of spices, rubs, seasoning, and sauces with playful names like ‘Potato Slayer’ and ‘Mayor Of Rub Town’ got their start back in 2018. Originally, the spices and seasonings were…...

Apr 17, 2024

Instacart Ads

Instacart Launches Target ROAS and New Acquisition Objective

New functionality brings increased control and efficiencies to reach new audiences At Instacart, we use an objective-based framework to organize our ad formats for advertisers creating new ad campaigns. Because our different ad formats are…...

Apr 16, 2024

Instacart Ads

Saffron Road Campaign Generates 68% Incremental Sales Lift

Saffron Road is America’s largest brand in “Better for You” animal protein-based frozen dinners. They deliver clean-label, high-quality, and ethically sourced products that respect cultural traditions from around the world. Saffron Road was an early…...

Apr 9, 2024

How Consumers Shop on Instacart – Unique Consumer Behavior

How Consumers Shop on Instacart – Unique Consumer Behavior  Advertising on Instacart 101: Where Do My Ads Show?

Advertising on Instacart 101: Where Do My Ads Show?  How Instacart Ads provides value today and in the cookieless future

How Instacart Ads provides value today and in the cookieless future