Instacart Ads

Let’s Get Snacking — Back to school trends on the Instacart marketplace

Snack trends can pack a punch. Earlier this year, we released our Pudding Pack Index – Instacart’s index for normalcy through the lens of grocery data. It turns out that a collection of quintessential kids’ lunchbox items like pudding packs, granola bars and fruit snacks is the single strongest indicator in Instacart’s massive grocery catalog that America is on the move again.

This month, as families prepare for the back to school season, we wanted to take a look back at some other impactful snack trends on the Instacart marketplace.

Instacart is available to 85% of the households in the U.S., and nearly 40% of customers are parents. By tapping into this rich, relevant database, we were able to see how consumers have been shopping for snacks in recent years. Due to the COVID pandemic in 2020, the traditional back to school season saw unexpected behavioral shifts as families embraced a blend of online/in-person learning. So, we looked back at 2019 and found some noteworthy trends.

What snacks are back to school snacks?

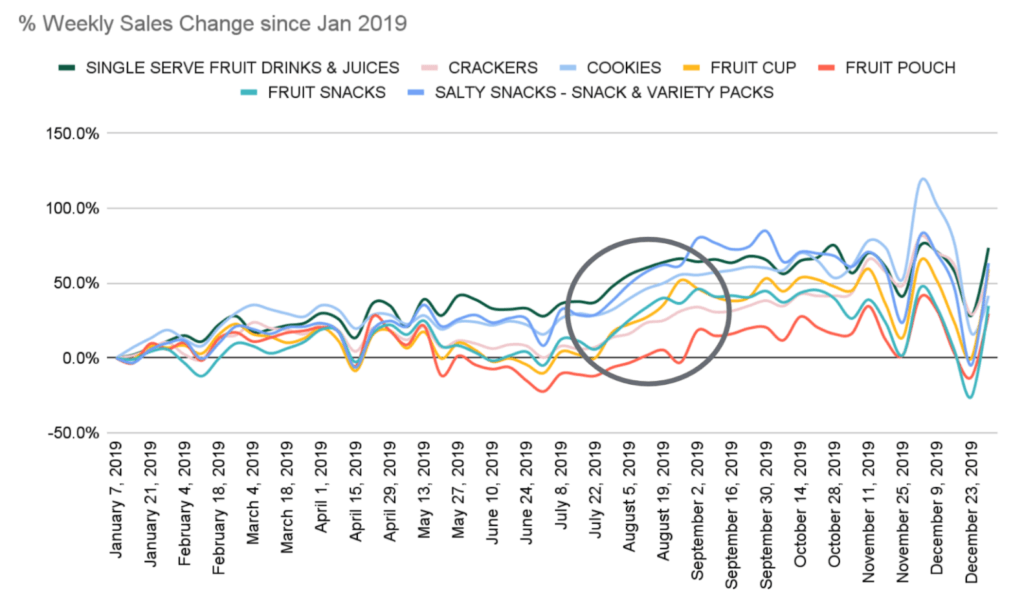

First, we wanted to confirm back to school had an impact on typical lunchbox items and snacks. So we took a look at weekly sales changes throughout 2019.

We see that the back to school shopping period in August acts like a starting line for sales of these snacks — with sales increasing during August and remaining high until the holiday season. Salty snacks and cookies see the biggest weekly sales gains, suggesting their sales are more closely tied to back to school than sales in the fruit pouch category, which did rise, but by the smallest amount during back to school.

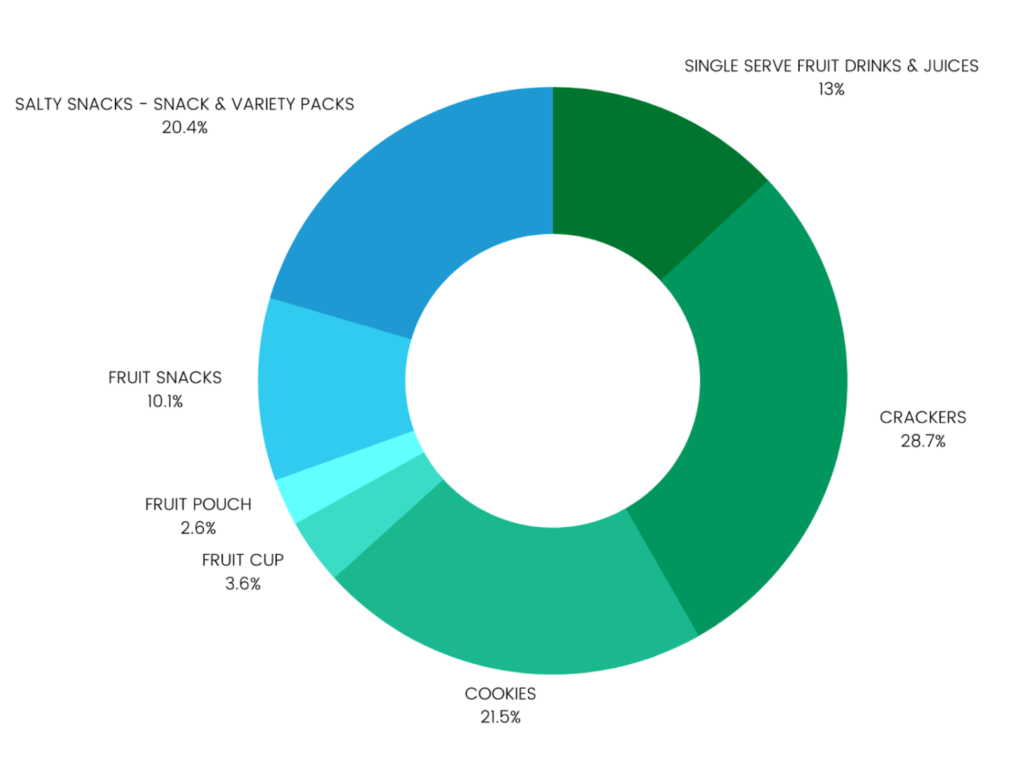

Looking into the proportions of snack sales during this back to school shopping season, we see that salty snacks and cookies make up over 40% of the snacks purchased on the Instacart marketplace. While sales in the fruit snacks, fruit pouch, and fruit cup categories account for a little over 15% of the total sales during the weeks of August 5th to September 9th.

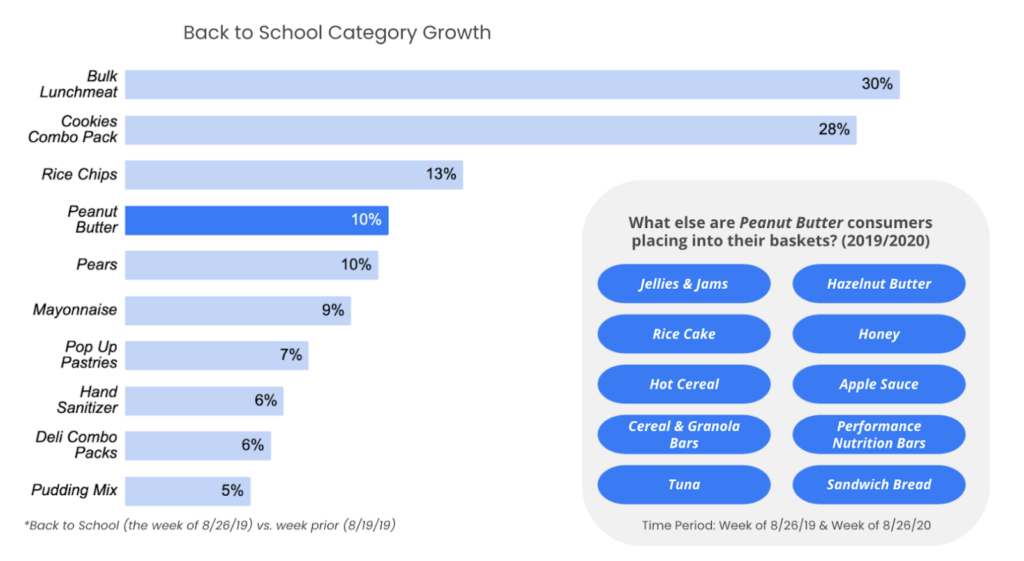

Percentages of back to school snacks purchased between August 5th to September 9thFocusing on more specific categories, we saw sales in the Bulk Lunch Meat and Cookies Combo Pack categories grow significantly (30% and 28% respectively).

Pears were the only fruit with double-digit growth.

Looking at what else consumers were buying along with these top-growing categories suggests these were shopping missions focused on back to school. For example peanut butter had common lunchbox and breakfast items in its top basket affinities, like spreads, sandwich bread, tuna, apple sauce, and different kinds of bars.

What else goes in the lunchbox?

So it seems cookies, salty snacks, and crackers have a place in the lunchboxes of America’s students. Which raises the question, what else goes in the lunchbox? Do we see other trends in back to school shopping on the Instacart marketplace that can help us paint a picture of a typical lunchbox?

Again, we analyzed 2019 data as it represented a more typical back to school season and zeroed in on the week of August 26. We found some notable increases—

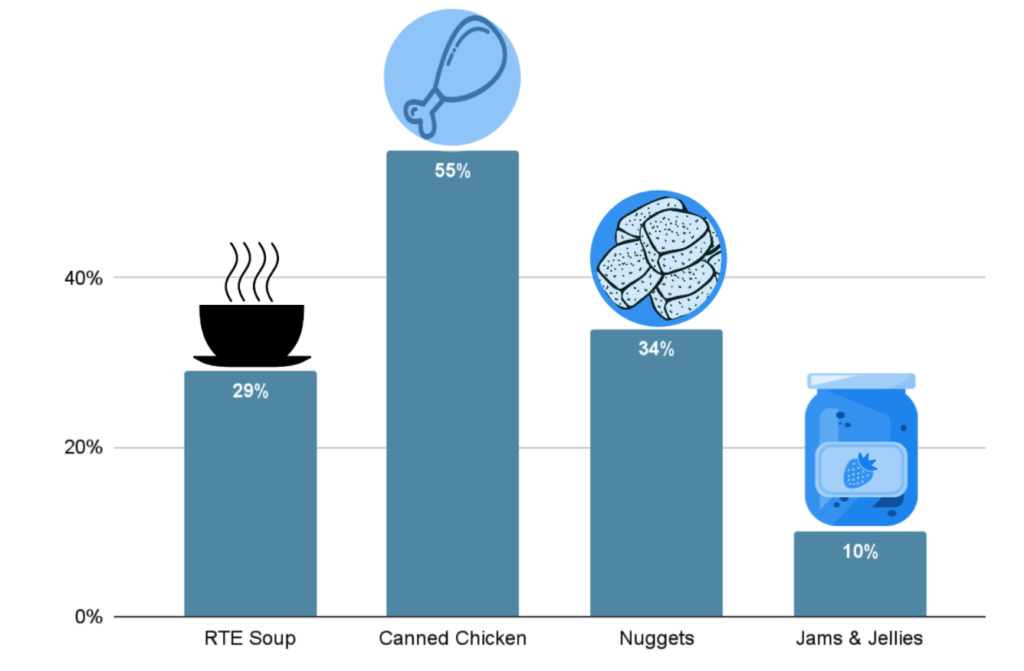

Ready to Eat (RTE) soup, canned chicken, nuggets, and the jams and jellies category all saw double-digit growth compared to their 2019 weekly sales average. Canned chicken sales grew the most, 55% the last week of August over their weekly sales average for 2019.

Another aspect to consider when pulling out data to describe the typical lunchbox is the basket affinities of some of the main snack items bought during back to school season — a basket affinity describes how likely products (or brands, categories, or sub-categories) are to be bought together, we cover them in more depth here.

Looking at the basket affinities for cookies and crackers, we see regular marshmallows, fruit snacks, dessert bars, muffins, pretzels, cereal, granola bars, and pop-up pastries. For fruit juice, we see basket affinities for other drinks like smoothies, vegetable juice, and sparkling water, plus some breakfast items like pancakes, muffins, and raisin bread, and some lunchbox material like apple sauce, fruit snacks, peaches, pears, and mandarins.

The absence of any traditional dinner meal items — salads, meat, pasta, seafood, rice — in the basket affinities for these back to school snacks or in the top category growth and weekly sales growth during back to school shopping season suggests these shopping missions really are about food for the kids — their breakfasts, lunches, and snacks — and dinner time for the whole family is sorted during a different shop.

Interested in learning more insights about how your categories perform on the Instacart marketplace? Then you’ll want to partner with us.

Most Recent in Instacart Ads

Instacart Ads

Fire & Smoke Society Spices Up Sales with Instacart Ads

Fire & Smoke Society, the makers of spices, rubs, seasoning, and sauces with playful names like ‘Potato Slayer’ and ‘Mayor Of Rub Town’ got their start back in 2018. Originally, the spices and seasonings were…...

Apr 17, 2024

Instacart Ads

Instacart Launches Target ROAS and New Acquisition Objective

New functionality brings increased control and efficiencies to reach new audiences At Instacart, we use an objective-based framework to organize our ad formats for advertisers creating new ad campaigns. Because our different ad formats are…...

Apr 16, 2024

Instacart Ads

Saffron Road Campaign Generates 68% Incremental Sales Lift

Saffron Road is America’s largest brand in “Better for You” animal protein-based frozen dinners. They deliver clean-label, high-quality, and ethically sourced products that respect cultural traditions from around the world. Saffron Road was an early…...

Apr 9, 2024

How Consumers Shop on Instacart – Unique Consumer Behavior

How Consumers Shop on Instacart – Unique Consumer Behavior  Advertising on Instacart 101: Where Do My Ads Show?

Advertising on Instacart 101: Where Do My Ads Show?  How Instacart Ads provides value today and in the cookieless future

How Instacart Ads provides value today and in the cookieless future